Bet against crude oil fall

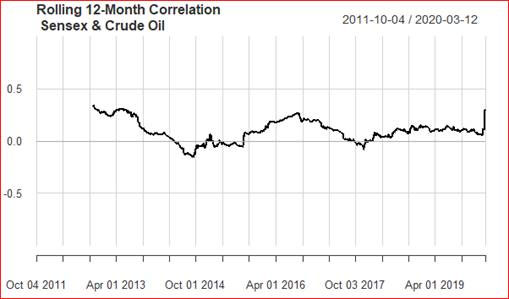

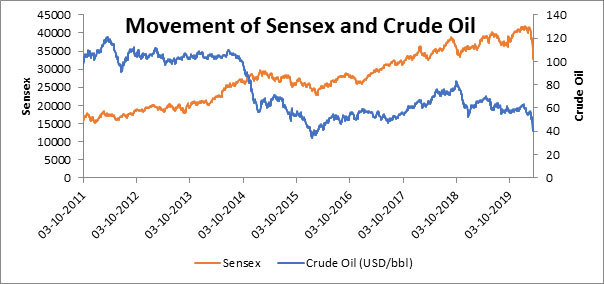

The movement in crude oil price has become one of the most important economic indicators in recent time. The recent sharp plunge in its prices has a negative impact on the equity indices. Contrary to the normal belief that falling crude oil prices is good for the Indian stock market, we see that it has a positive relation with Sensex. This means that when the price of crude oil falls, Sensex also drops and vice-versa. Correlation between the daily BSE Sensex returns and daily brent crude oil prices return is 0.16. This correlation increases with a sharp movement in crude oil prices. This is reflected in the current scenario, where the correlation between them doubled.

Even if we notice the movement of crude oil prices and BSE Sensex, we will see that after 2014, they are moving in tandem.

Doing a correlation analysis between Sensex and crude oil shows that two per cent of Sensex movement can be explained by way of movement in crude oil prices.

Companies with positive & negative relation with crude oil prices

So, which are the companies that will benefit from the fall in the crude oil prices? Last time, we saw such a fall in crude oil prices, from mid of June 2014 and 2015-end. Hence, we did a study of returns of BSE 500 companies between them, where we analysed the companies that have outperformed the benchmark, BSE 500 and has higher alpha and lower beta.

Following is the list of companies with the lowest ‘beta’ and highest ‘alpha’:

|

Companies

|

Alpha

|

Beta

|

|

Swan Energy

|

0.02

|

0.22

|

|

Abbott India

|

0.30

|

0.33

|

|

Glaxosmithkline Pharmaceuticals

|

0.06

|

0.35

|

|

Glaxosmithkline Consumer Healthcare

|

0.07

|

0.37

|

|

Sanofi India

|

0.06

|

0.38

|

|

Hindustan Unilever

|

0.08

|

0.42

|

|

Bajaj Holdings & Investment

|

0.08

|

0.42

|

|

Procter & Gamble Hygiene & Health Care

|

0.08

|

0.45

|

|

DB Corp

|

0.00

|

0.46

|

|

Tata Consultancy Services

|

0.02

|

0.48

|

Following is the list of companies with the lowest ‘alpha’ and highest ‘beta’:

|

Companies

|

Alpha

|

Beta

|

|

IDBI Bank

|

-0.09

|

1.94

|

|

Jai Corp

|

-0.12

|

1.97

|

|

JSW Energy

|

-0.03

|

1.98

|

|

DLF

|

-0.21

|

1.99

|

|

Oriental Bank Of Commerce

|

-0.30

|

1.99

|

|

Jain Irrigation Systems

|

-0.19

|

2.02

|

|

Adani Power

|

-0.22

|

2.10

|

|

The India Cements

|

-0.09

|

2.29

|

|

Indiabulls Real Estate

|

-0.16

|

2.42

|

|

Adani Enterprises

|

-0.51

|

2.53

|

Looking at the above analysis, it is better to avoid high beta companies and instead, increase your focus towards MNC pharmaceutical that would prove to be a better bet in such times.