Sundaram Mutual Launches Multi-Factor Fund: NFO Opens July 2

New NFO offers diversified factor exposure to navigate market cycles with discipline

Sundaram Mutual Fund has announced the launch of the Sundaram Multi-Factor Fund, an open-ended equity scheme that adopts a multi-factor-based investment strategy. The New Fund Offer (NFO) will open for subscription on July 2, 2025, and will close on July 16, 2025. The scheme will be available for continuous subscription and redemption from July 28, 2025.

Investment Strategy: Rules-Based, Multi-Factor Approach

The fund is designed to invest in stocks selected based on multiple quantitative factors such as Quality, Growth, Momentum, Value, and Size. It will follow a structured, rules-based approach—similar to those employed by systematic active managers—to ensure consistency and objectivity in portfolio construction.

The selection universe includes the top 250 companies by market capitalization. From this, the fund will shortlist top 25 stocks under each factor, periodically rebalanced on a quarterly basis to maintain alignment with the defined model.

The investment objective is to generate long-term capital growth through diversified exposure across styles, aiming for better risk-adjusted returns across market cycles.

Views from Sundaram AMC

Speaking on the launch, Mr. Anand Radhakrishnan, Managing Director of Sundaram AMC, stated that the fund attempts to replicate the discipline of active managers using transparent, repeatable rules. He emphasized the role of multi-factor diversification in enhancing performance consistency and risk control.

Scheme Details

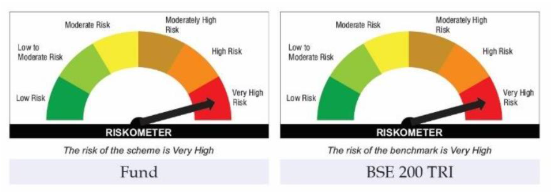

- Benchmark: BSE 200 TRI

- Fund Managers: Rohit Seksaria & Bharath S (Equity), Dwijendra Srivastava & Sandeep Agarwal (Fixed Income)

- Asset Allocation:

- Equity & related instruments (Multi-Factor model): 80–100%

- Debt/Money Market Instruments: 0–20%

- REITs/InvITs: up to 10%

- Exit Load:

- 1% if exited within 365 days

- Nil thereafter

- Investment Options: Regular & Direct Plans | Growth & IDCW options

- Minimum Investment: ₹100 lump sum; SIPs starting from ₹100/month or ₹1,000/week

Riskometer:

Why a Multi-Factor Strategy Now?

As traditional investment styles face periodic underperformance, the fund seeks to mitigate this by diversifying across multiple established factors. The strategy may appeal to investors aiming to balance style-specific risks and reduce portfolio cyclicality.

Conclusion

The Sundaram Multi-Factor Fund offers a systematic route to equity investing by combining various proven factors within a single portfolio. With its model-driven and rebalanced structure, the scheme aims to deliver sustained long-term performance across varying market conditions. Investors interested in exploring factor-based investing within an equity framework may evaluate the fund during the NFO period from July 2 to July 16, 2025.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please read all scheme-related documents carefully before investing.